A few months ago we published a post on 11 personal finance goals for your 20s. Today we take a look at 7 personal finance goals for your 30s. While many of the goals you should set during this decade of your life are simply a continuation of those you hopefully started on in the previous one, your thirties bring some unique personal finance challenges that didn’t exist when you were a relatively carefree 20-something. As a friend once put it, “In your 30s, you’re just running.” You’re likely married, have small children, and your career is starting to take off — everything’s launching and/or accelerating at once. And with these new responsibilities come new personal finance goals.

As you read the suggested personal finance goals for your 30s, keep in mind that everyone is in a different place, so naturally everyone is going to have different objectives. But if you’re feeling confused and overwhelmed about money, it’s sometimes helpful to see suggestions for milestones to hit at certain points in your life. You can then take those broad suggestions and refine them so they fit your personal circumstances.

1. Save six months of income in your emergency fund. Hopefully by now you’ve started an emergency fund. In your 20s, the goal was to get at least $1,000 in your savings account before you started paying off your debt. This provided a small cushion to prevent your financial life from derailing in the face of unforeseen expenses. In your 30s, you likely have more on the line than you did in your 20s — like a wife and kids to take care of and a mortgage. While having $1,000 in savings will certainly help, you’ll want even more security than that in the event you lose your job due to a layoff or injury. To that end, make it a goal to save at least six months of income in your emergency fund while in your 30s. Why six months? Studies have shown that after you lose a job, it takes around that amount of time to get a new one. Having six months’ worth of income in your savings account will ensure that you can continue to support your family while you’re hitting the pavement looking for a job.

And besides protecting you from negative events, having six months of cash in the bank gives you a bit of freedom to take some risks. Maybe you finally want to start that business you’ve been dreaming about or perhaps an opportunity comes up to travel for three months. Your emergency fund can help you take advantage of those opportunities.

In short, six months of cash in the bank is one very effective way of becoming more antifragile.

For extra personal finance points, try to save one year’s worth of income by the time you turn 40.

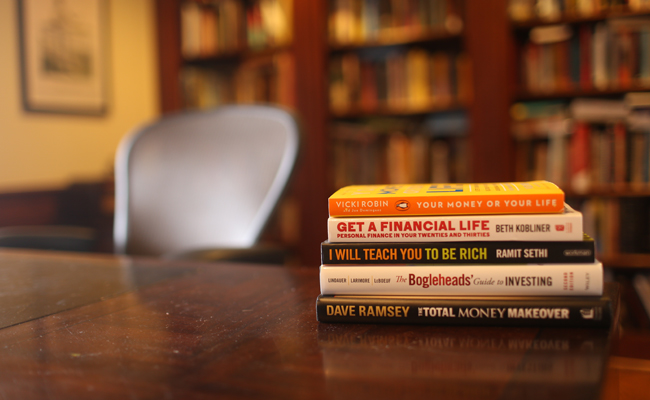

2. Pay off all-non mortgage debt. In your 20s you paid off all your credit card debt and started a debt repayment plan for your student loans. In your 30s, the goal is to stick to that plan — keeping credit card debt at bay and paying off all your non-mortgage debt. Be aggressive with it. Slash your expenses with frugal living, earn extra money through side hustles, and divert as much of your savings and income as possible towards eliminating your student loans and any other debt. If you don’t think it’s possible to pay off your debt while trying to support a family with an average income job, just read the experiences of folks who followed Dave Ramsey’s Total Money Makeover program. You’ll find several examples of families of five or six, where the husband was the sole full-time income earner, who still managed to pay down down six-figures of debt in just a few years. It just takes dedication and sacrifice.

3. Increase retirement savings to at least 15%. Hopefully by now you have some sort of retirement account set up and are making regular contributions to it; you won’t be one of the 40%(!) of Baby Boomers who have nothing saved for their golden years. As you pay off more of your debt, start shifting some of the money that’s no longer going to loans to your retirement account. Most personal finance experts agree that in your 30s you should be saving at least 15% of your income for retirement. If you want to make sure you have plenty, aim for 20%. Don’t know what to invest in? Check out our post on index funds — the best stock market investment option for just about everyone.

4. Get your estate planning in order. You’re going to die someday. Could be in 50 years or it could be tomorrow. Whenever it happens, your estate will have to be set in order and distributed to your survivors. If you want to control how your stuff gets doled out when you’re gone and make the process as hassle and conflict-free as possible for your loved ones, you’ll need to have a will or a trust in place. Wills and trusts are particularly important if you have children. If you and your wife both die, who do you want to take care of them? How do you want the money in your accounts spent to raise them? In addition to a will or trust, your estate plan should have documents like an advance directive and durable power of attorney. Instead of your family arguing about whether to pull the plug on you when you’re in a coma, make that decision yourself with a living will and a health care surrogate designation (the person who gets to call the shots when you’re incapable of doing so).

For more information, see our article on estate planning.

5. Consider term life insurance. When you’re in your 30s, you’re starting to build up a financial foundation that permits you to give your family comfort and security. But what would happen if you died tomorrow? Would your family still be able to live comfortably or would they be scrambling to figure out how to make ends meet because you’re no longer around to provide for them?

Take a step to ensure your family is taken care of by purchasing term life insurance.

It’s key that you make sure the life insurance policy you get is term life insurance. There’s another type of life insurance out there called cash value or whole life policies that are much more expensive and confusing; it lasts for your entire life, and you have to pay into it until you die. With term life insurance, on the other hand, you pay a monthly premium for a set term (could be 10, 20, or 30 years). If you die within the term, the insurance company will pay out a specified amount to your beneficiaries. So for example, if you bought a $500,000, 20-year term life insurance policy, if you kicked the bucket 10 years after purchasing the policy, your wife (or whoever you set as the beneficiary) will get $500,000 from the insurance company.

Most people don’t buy life insurance because they think it costs too much. But as financial planner Jeff Rose wrote in a previous post:

“Not true! A healthy 35-year-old man can get $500,000 of term insurance for 20 years for the price of 6 Double-Doubles per month at In-N-Out Burger. While you won’t get the same immediate gratification when making the payment, you can rest assured that your family is taken care of.”

And what if you outlive the term of the policy? Well, congratulations! You’re still alive. That’s great news. Hopefully, you’ve been saving enough during that time that you’ll have so much money that you won’t need another insurance policy to take care of your loved ones after you die of old age.

6. Start a 529 plan for your kids. I don’t know what the future of higher education is going to be. Perhaps in the next 15 years, people will be able to get a college education for free online, or maybe college tuition will keep increasing at a rate of 5% each year. I’m hoping for the former, but banking — quite literally — on the latter. As soon as each of my kids were born I set up a 529 college savings account for them to which I now make regular monthly contributions. While you can’t write off the amount you contribute to a 529 on your taxes, the interest the account generates is tax free. So if Junior’s plan earns $10,000 in interest, you don’t have to pay taxes on that $10,000 when he starts withdrawing money to pay for school.

If your child decides not to go to college, you can re-assign the account to another child and pass along the tax-free earnings. If that’s not an option, you can cash the account out but pay a 10% penalty on the earnings accrued.

7. Get an accountant (if your finances are complex). When you were in your 20s, your finances were probably rather simple. You may have had just a checking and a savings account and maybe a few bills. When you get into your 30s, your finances start getting more complex — mortgages, home owners insurance, multiple retirement accounts, college savings plans, maybe even a side-hustle business. All these additions to your financial picture will definitely make taxes more complicated. While you can use software to guide you through the process, a certified personal accountant can make sure you’re not paying more in taxes than you should be and will save you a ton of time — especially if your finances are a little more complex than the average Joe.

Up until a few years ago, I did my own taxes with TurboTax. With expanding business and financial complexities, taxes took me forever and I was definitely leaving money on the table. So I decided to hire an accountant, and it is easily one of the best decisions I’ve ever made. She quickly found places where I was overpaying on taxes. Best of all I hardly spend any time on my taxes myself. Just a few minutes gathering forms for her and then reviewing them before I send them in.

Any other financial goals you think a 30-something should aim for? Share them with us Twitter or Facebook!