If you find yourself running out of money before your next paycheck or if you’ve been having trouble making a dent in your debt, then you, my friend, need a budget.

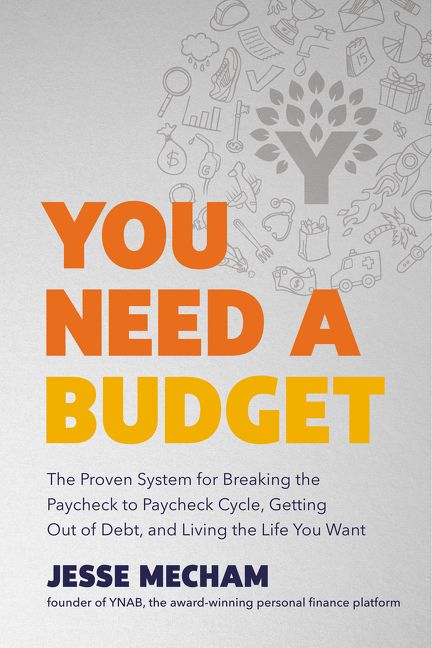

My guest today is Jesse Mecham, he’s the creator of the You Need a Budget system and software and he’s just written a book about the philosophy underpinning his system. It’s called You Need a Budget: The Proven System for Breaking the Paycheck to Paycheck Cycle, Getting Out of Debt, and Living the Life You Want. Today on the show, Jesse tells us the personal story behind his software, why most people fail at budgets, and the myths people have about budgeting. He then walks us through the four rules of the You Need a Budget system, as well as actionable advice on how to implement them. Whether your goal is to pay off your debt or to simply get some control over your finances, this episode is for you.

Show Highlights

- Why people have a hard time keeping to a budget

- Why perfectionism hurts your budgeting

- The difference between budgeting and forecasting

- Why surprise expenses shouldn’t actually surprise us

- The 4 rules of budgeting

- Why your budgeting needs to incorporate flexibility

- Why the money you earn today shouldn’t be spend for about 30 days

- How do you “give every dollar a job”? What happens when you don’t have money to pay for your expenses?

- How can you eliminate some of the tediousness of categorizing your spending?

- Expenses vs. “true” expenses

- How do you finance hobbies, goals, and dreams that lie outside the purview of your “needs”?

- Why Jesse isn’t actually a proponent of the emergency fund

- Why you should name your emergency spending needs

- How the “credit card float” can screw with your budget and why to treat your CC like a debit card

- What budget flexibility looks like

- How to handle your budget as your income goes up

- How to handle your budget when you bring a spouse into the fold? And kids?

- How do you pass along these tips to your kids?

- Tips for getting beyond budget fatigue

Resources/People/Articles Mentioned in Podcast

- You Need a Budget software

- Be Your Own Tyrant: John D. Rockefeller’s Keys to Success

- AoM’s Personal Finance Archives

- Financial Goals for 20s

- Financial Goals for 30s

- Why Everyone Should Have a Side Hustle

- Start a Debt Reduction Plan

- A Guide to Paying Back Your Student Loans

- 4 Money Tips From 4 Personal Finance Giants

- Podcast: The Opposite of Spoiled

You Need a Budget is a brass-tacks personal finance book. Jesse provides actionable advice on how to get your finances in order and how to finally stick to a budget. Pre-order it on Amazon.

Connect With Jesse and YNAB

Listen to the Podcast! (And don’t forget to leave us a review!)

Listen to the episode on a separate page.

Subscribe to the podcast in the media player of your choice.

Podcast Sponsors

RXBAR. A whole food protein bar made with a few simple, clean ingredients. Go to RXBAR.com/manliness and enter promo code “manliness” at checkout to get 20% off your first order.

Grasshopper. The entrepreneur’s phone system. Have a separate number that you can call and text from by going to grasshopper.com/manliness and get $20 off your first month.

Saxx Underwear. Everything you didn’t know you needed in a pair of underwear. Get 20% off your first purchase by visiting SaxxUnderwear.com/manliness.

Click here to see a full list of our podcast sponsors.

Recorded with ClearCast.io.

Read the Transcript

Brett McKay: Welcome to another edition of the Art of Manliness podcast. If you find yourself running out of money before your next paycheck or if you’ve been having trouble making a dent in your debt, then you my friend need a budget. My guest today is Jesse Mecham. He’s the creator of the You Need A Budget personal finance system and software and he’s just written a book about the philosophy underpinning his system. It’s called You Need A Budget, the proven system of breaking the paycheck to paycheck cycle, getting out of debt and living the life you want. Today on the show, Jesse tells us the personal story behind his software, why most people fail at budgets and the myths people have about budgeting. He will walk us through the four rules of the You Need A Budget system as well as actionable advice on how to implement them. Whether your goal is to pay off your debt or simply feel some control over your finances, this episode is for you.

After the show’s over, check out our show notes at aom.is/ynab where you find links to resources so you can delve deeper in this topic and Jesse joins me now via ClearCast.io.

All right, Jesse Mecham. Welcome to the show.

Jesse Mecham: I’m so happy to be here. Thanks for having me Brett.

Brett McKay: You founded a personal finance service called You Need A Budget and you just wrote a book the same title, You Need A Budget, the proven system for breaking the paycheck to paycheck cycle, getting out of debt and living the life you want. Well, about your story is like a lot of really successful useful businesses. You started You Need A Budget because you had a problem of your own that you had to solve. Can you give us the backstory of You Need A Budget?

Jesse Mecham: Yeah, I can do the two word one or about there, I mean we were young newlyweds. I was still in school and we were going to have a baby. We were naturally broke because when you’re married and in school that happens, but the baby really really extra stress for me. Julie my wife, and I, we were using this budgeting system that I created for the two of us and it worked pretty well despite pretty meager incomes. We were getting by. We’re actually able to save a little bit and then when the baby was coming, we really wanted Julie to be able to stay home and just be full time 100% with the baby and that would mean that her income would go away and I needed to figure out a way to shore up the gap and that was where I had the idea that I could sell our budgeting system to other people and I was just young enough, just not even enough to believe that would work so that’s where we started with.

Brett McKay: Let’s talk about budgeting in general because I think that everyone listening to this show has probably tried budgeting at some point in their life and they stick to it for about a week and then they go over and then they’re just like, “Okay, I’m just going to give up on this completely.” Why do most people fail at keeping a budget? What’s so hard about the way most people keep budgets?

Jesse Mecham: They do two things wrong. One is that they use a budget to forecast what they will earn and what they will spend and then we can get into details on that if you want, but then the second bit, it’s almost as if like I’m horrible at basketball, right. I used to be pretty good and I stopped playing around the time I was 12, haven’t touched a ball since. It would be like me deciding I’m going to play basketball again and demand that my free throw percentage be 95% and that’s what they do with their budget. They’ve never budgeted before. They’re probably pretty poor with their money, the management of it and then they just suddenly think because they’ve written down this budget or whatever they’ve done, that they’re suddenly going to be perfect and also probably be able to have psychic kind of future fortunetelling kinds of abilities and that just doesn’t happen so they blame the budget for the fact that they have this high level of perfectionism that they’re trying to live by and they’re just getting started. I have so many analogies.

I have weight training analogies, dieting analogies, all of them are the same. It’s like, “Listen, you’re just getting started, you know. Give yourself a break.”, so that would be no forecasting and no perfectionism and budgeting will live to go another day, but people approach too much with those two things in mind and kind of torpedo it from the outset.

Brett McKay: Let’s talk about the difference between budgeting and forecasting. Can you go to that more in detail?

Jesse Mecham: Yes, so what happens is, well what we really want to do is introduce scarcity into their decision making. That’s the principle and you just kind of make sure that you’re clear on that. If there’s scarcity in your system and you know you only have $300, $3,000, whatever it is that that amount is finite, then when I say, “Hey, Brett, what do you want to do with that $300 before you are paid again?” Then you are crystal clear on what your priorities need to be because we’re dealing with a very small or at least a very finite amount of money. When we forecast and you are as an entrepreneur and I’m in the same boat and 75% of Americans do deal with variable incomes of all sorts, they end up using the forecasting to pad their system with extra money and they kill the scarcity from it so you would say, oh, maybe you’re chatting with your wife or something and it’s kind of like, “Okay, we want to do this, this. Well how’s it going to work?”

You think to yourself, “Oh, well I’ll make some more money here. This will probably happen. This good thing in the business, we’re going to do this launch.” We all come up with all these like really rosy ideas, like looking through the future like through these rose colored glasses and then answer and trying, instead of prioritizing brutally honestly and say, “Listen, this is the amount of money we have.” We then say, “Oh, no. I’ll make more.”, in order to not have to deal with the question of I have a finite amount of money. You can do this with a fixed amount of income when you’re on the most sure paycheck of all or you can do it when you’re a realtor just jumping from one house sell to the next, but we forecast to make ourselves feel better about or to avoid essentially the idea that there’s a finite amount of money that we’re dealing with. When we first start someone out, I just say, “What’s in your bank account?”

They tell me, I don’t care what the amount is and then I say, “Okay, what do you want that money to do before you are paid again?”, and their stress suddenly disappears. They feel very purposeful, very intentional and we’ve completely removed that murky area where someone’s guessing what amount of money they should be dealing with.

Brett McKay: Got you. I guess another part of that besides the amount of money that’s coming in, you’re also budgeting for, we’ll give this more details like unexpected expense. They’re expected expense but they don’t show up very often.

Jesse Mecham: Yes, yeah, we call that, that’s the second rule of our system where you’re embracing your true expenses and these are larger less frequent expenses that tend to surprise and that shouldn’t, so we probably drive cars and you know, if you drive a car on the road, it has tires that continually rotate at that high velocity, that they’ll wear down, yet we’re all surprised when we have to replace our tires. Then some of us say well I don’t know when it will happen and I say that’s fine, you don’t know when but you do know that it will happen and we know that having money saved for it is better than having zero saved for it, so what we want people to do is look ahead to those larger, less frequent expenses and then start to break them down into manageable monthly amounts and give yourself monthly bills that you’re dealing with.

If it’s a vacation that you’re saving for or it’s Christmas that you’re getting ready for, we want you to get ready for Christmas in January and then be ready every month, setting aside a little bit of that Christmas bill so that come December, you just enjoy yourself and it’s actually merry instead of stressful. The idea is that the money, you have a pile of money waiting for a bill to land instead of a pile of bills just waiting for you to finally land some money to take care of them.

Brett McKay: Got you, like you said, rule two, embrace your true expenses. Let’s talk about these rules because you jumped right through it. Let’s talk rule number one, we skipped rule number one. What’s that?

Jesse Mecham: Rule number one is to give every dollar a job, and that goes back to that principle. You don’t forecast. It’s just what amount of money do you have on hand right now, and you’re just prioritizing, and prioritization in and of itself is fairly simple in concept but actual doing can be quite challenging, so we want all of our money to go towards specific purposes. What people end up doing is just behaving very reactively with their money and as a result, with their life, and if you can be intentional and proactive with your money, and you say I want my money to do these things. I want my money to do that, then suddenly you feel purposeful, and your money, it’s not that you’re cutting back. You’re not saying oh, I’ll spend less here, I’ll spend less there. That’s a very boring conversation for me to have. I would never want to talk to you about here’s how people save money, not that people shouldn’t or that’s bad. It’s just that’s boring to me. I want people to just be very purposeful about what their money is doing.

That’s rule one is that purpose driven, what should this money do before I’m paid again, so we call that giving every dollar a job. Rule two is it’s a spin on rule one, just prioritizing again but looking ahead to the larger less frequent expenses, breaking them up into monthly amounts and making sure that as you’re deciding what your money should do, you’re also keeping in mind future Brett that’s out there that’s like hey man, I’m the guy that’s stuck with the blown out tire, throw me a bone here you know, and so you’re just always kind of looking ahead and saying okay, I don’t want to leave future Brett in a lurch here so let’s throw some money his way as well, so he’s not stranded on the side of the road with a blown out tire and no money to boot.

Our third rule is to keep rolling if you want, is to give, it’s essentially give some flexibility to the system so when people first start, we talk about that perfectionism. We really want people to recognize that out of the gate, it is a rule that you change your budget as you go. It’s like playing chess. If someone opens one way in chess, you’ll respond and then they’ll play and you respond. Everything’s a give and take. Everything’s a response to something else, and your budget is the exact same way. You have a plan, like a great football coach has a plan they’ve been working on for a week, and then as soon as the other team steps on the field and they start to open up their playbook and showing their hand a little bit, a good coach adjusts and adapts and responds.

A horrible coach would yell at their coach and say no, no, no, I set up my plan. I’m never going to change it. That would be the worst coach in history. They wouldn’t have a job in more than a few games, so in budgeting, it’s the same way. When something happens and it wasn’t what you foresaw, you just change the budget a little bit and keep rolling. A perfect budget is a budget that is done again and again and again, not one where you have to guess right on what you would spend on any given amount.

Then our final rule is to age your money, and that’s the idea that we want you stepping away from the financial edge and spending money that you earned at least 30 days ago. If you earn money today, you won’t need to spend that money in your normal flow until about 30 days from now, and it has all sorts of benefits we can dive into if you want but the idea is just getting away from that financial edge, getting away from the stress and being able to make better decisions as a result.

Brett McKay: Okay, that’s a great overview. Let’s get into some of the nitty gritty on how to implement this. Rule number one, give every dollar a job. Let’s say you talked about this in the group, everyone has their obligatory expenses, mortgage, rent, gas, utilities, student loan payments perhaps. You sit down, you look at your bank account, you assign every dollar in your bank account to those expenses. What do you do if you don’t have any more money left for other expenses like say the true expensive replacing the tires, like putting aside that for when that happens? What do you do there?

Jesse Mecham: One is you don’t pretend you do. The one thing people would do is they’ll just immediately say I will earn some money in a few weeks so I’ll go ahead. No, don’t. When new money comes in, then fund the tires. We could actually go on route here where we talk about people that genuinely have an income issue, where they really don’t make enough to fund their current requirements. That is a very real case but it is not the majority of people. The majority of people have enough and they’re just mismanaging it. What happens is the reason I’m leery of talking about not having enough money is only because most people say that as an excuse to not even start. They’ll be like listen, I already know I spend more than I make and it’s just the way it is and so I can’t budget, just show me what I already know, and I think it couldn’t be further from the truth. Budgeting lets you be proactive to make sure your money is doing what it actually is supposed to do, and if we can get people doing that, a lot of the times, like 90% of the time, their money starts to line up, not be wasted on things that they actually don’t really care about and they end up with some surplus.

This really does happen in 90%, 95% of our cases, where they end up with surplus and they feel like they got a raise, and it’s not because we’ve said don’t spend money here. How could you buy that? I can’t believe you spent your money on this, none of that. They just are more purposeful and suddenly they find more money. It’s the same thing people experience when they start planning their day. They’re like oh gosh, this day felt, I thought I had more time on my day. It’s the same principle. You’re just being purposeful about what you wanted to do with that resource, and that resource suddenly seemed more abundant. I might have gone off a little bit on a tangent there but that idea of not having enough, most of the time it’s just using it as an excuse for people not to start.

Brett McKay: Got you, and then another thing I’ve had problems with budgeting in my experience is that I set my budget, I create these little buckets for different things, but all the money is in one account and so I’m spending, I had to keep in my head this money is associated for this but I look at my account, I’m like oh I’ve got lots of money there that could be used. What do you do? It’s more of like, I think it’s a psychological issue than anything.

Jesse Mecham: Yeah, it is. What’s happening, you’re most of the way there, so you’re making the decisions that you need to make. A little bit on the implementation maybe, could be tweaked but what people do a lot of the time is they’ll move money to different accounts to really have it be out of sight, out of mind. I find that to be very tedious for the most part and when you need the money, you go to transfer back and this back and forth and this little bit of a revolving door of a savings account situation happening. What we do is, and I don’t want to speak to the software specifically too much because people can hear this podcast. They can read the book. They don’t need to use our software to implement what we’re talking about so I want to be very clear there but in this software, it’s built to show you all those buckets and to show you the balances you have so when you plug your phone and you say hey honey, let’s go out to eat and there’s $19, you’d say okay clearly we’re doing Little Caesar’s Pizza tonight, not the sushi I thought, but your decisions are being dictated by the $19.

You may have $7,000 in your bank account but you’ll only look at the relative related bit there for that one job, going out to eat. YNABers, most of the time, we’ll just say, they’re not even aware of what their checking account balance is, they get funny looks from tellers at the bank sometimes because they’re just kind of like why do you have so much in here, but at the end of the day they’re looking at each individual category balance and then they will say okay, I have enough for I’m going to go out and do whatever hobby I have, I’ve got money. I’m going to go play some golf. I’ve got money to go out to eat. We’ve got money to go to the movies, not looking at that big pile where you think gosh, I have so much money I could do whatever I want, then you’re back to making decisions based on how big the checking account balance is and that’s a recipe for disaster.

Brett McKay: That’s great. Here’s another sort of, it’s probably a tedious question. Another issue I ran into that kind of like made budgeting frustrating for me is when I went grocery shopping for example at Super Walmart where they have more besides groceries, and then so you buy food but then you also buy other stuff that could be categorized as something else. I don’t know. Who knows? Automotive, whatever and I’m like okay, how do I do with this. What’s your take on that?

Jesse Mecham: My take is to make things easy in my life as possible, and maybe that goes against your strenuous life. There are things where there’s no value add to the strain so I want to eliminate those, and this is one of those where you can say okay, could my categories be lumped into such a way where I can just say oh, that’s all in one category? That’s one stop where you can just say I’m going to throw diapers in with groceries. The other thing you could do and in our software, you split the transaction, you can just ballpark it. I would never have someone sit there with the receipt. I’m a former CPA so I get the whole all the jokes about CPAs and calculators. I can do all those but what you really want to, you kind of look at the receipt and you say okay, most of this was groceries except I bought new dash mats and they’re about $20, so you put the $20 in and then you say okay, the rest was food and you’re done. It’s hopefully not too tedious but if it is too tedious, you’d say can I make my categories a little less granular or I make myself just not care as much or can I just ballpark things to have it not take up so much time?

There’s no value in the recording of the transaction itself except maybe a little bit of awareness about the actual spending. The real value is the decision making you made beforehand and how much you wanted to spend, and then just the accuracy afterward. You want to make sure that you’re tracking your spending so that you can make accurate decisions but we don’t want things to be tedious. That just is a recipe for people quitting. I hear you on that because it’s annoying especially if you’re a little bit of a Type A, like you want to be exactly right, then it’s particularly annoying.

Brett McKay: Got you, so let’s say you’ve embraced your true expenses and you have all these things that you wanted, but how do you, I think one of the hard things of money is prioritizing things, so you take care of your obligatory expenses, you listed out the expenses for car repair and things like that, bu then you have these other things like these ambitions, these dreams and they’re all equally good and it’s hard if you’re okay, which one do I focus on actually? Do you have any insights there, like little mind hacks that help you decide which one to prioritize at any given moment?

Jesse Mecham: Yeah, what I’ve done for myself, I used to get mad at myself for switching interests. Back in 2009, I got really into golf and I would just play it all the time, and I got to where I wasn’t embarrassing. I maybe shoot I don’t know 18 over, so bogey. I was actually playing bogey golf, which made it pretty fun, then you start caring too much and it makes it less fun but I got really into golf for a while and then I stopped, and now if I were to play it, I’d probably shoot pretty horribly. I got into guns for a while and still into it to a degree but I did all these courses and got really the marksmanship and then my interest kind of waned. I got a dog for a while, and I trained this dog. I went into like shih tzu training and I was in a bike suit one time, running away from this dog that was chasing me. We were doing training. It was super fun and exhilarating, very exhilarating like this exercise I never imagined.

This is kind of a long way of saying you have these interests, if you’re an interesting person, it means your interests will be interesting. You have to give yourself permission to switch your priorities around and not feel like you’re doing something wrong. I’m just talking me personally now. That was a big deal for me because I used to feel like I haven’t maximized that. I haven’t really become really proficient and if I could just hit the 10,000 hour rule or whatever, maybe that’s a myth, I don’t know, but that idea, it just bothered me, and then one day, I realized oh wait, my thing is that I like to try lots of things and so I should be okay with that and suddenly I am. My prioritization, just to go back to kind of brass text, I always prioritize giving first and making sure I had the best way to just really, as far as my next goal, you’re just saying hey money, I don’t need all of you and that right away is very empowering.

Number two is you just take care of needs and you got to be really careful about what are needs versus wants and then above that, I really try and fund those goals and we look as a family, Julie and I, we’re looking usually about a year, maybe two years out, and we do it every January and we just pick the big ambitious stuff we want to do. Right now, I’m chatting with you, I’m in Manhattan and we knew the book was going to be launching so we decided we’re going to spend three months in Manhattan with the kids. We have six kids so it’s this crazy experiment and it’s been super fun and really interesting to see. It was just a decision we made about a year ago.

When I’m talking about prioritization, I really want people to recognize, one take care of your needs first and make sure you’re giving a little because I think it’s healthy for you. It doesn’t give to whatever you want however much you want but give a little bit, and then be okay with your priorities shifting around as new opportunities arise and I don’t know, you feel like a new want pop in.

That’s hardly budgeting at all really. It’s just, it’s prioritization of itself but that’s kind of a personal thing of mine that I’ve been living the last sort of while, so hopefully, one of your listeners gets something out of that.

Brett McKay: What’s your take on debt, paying it off?

Jesse Mecham: I don’t like it. I’m not morally opposed to it. I bought rental properties a while ago and mortgaged the rental properties through that, so the reason debt is bad is because if our job is to give every dollar a job, as it comes in, you say I want this money to go do that thing, if half of your money or some meaningful chunk of your money is going toward paying debt, that means it’s going toward things that have already happened by definition, and with the exception of a house. With that in mind, it’s kind of like debt, debt is just keeping you from doing what you want. It’s keeping you from giving every dollar a job because you aren’t able to fund the things you really want. You’re paying for prior mistakes, for prior bad luck or whatever you want to call it, so debt, it claims your cash before you can budget it and that’s why I don’t like it.

People need to get rid of it as fast as they reasonably can and I personally like to have it be a very rapid pace because as soon as you’re out of it, that cash flow that’s freed up, it can just do wonderful things for you as far as achieving goals and funding things that you really want to do with your life and until then, it’s a bit of a ball and chain around your ankle, so especially the student loan debt, it’s particularly, it’s inexpensive but it can be so large for a lot of people. Yeah, it can really be a ball and chain for a lot of young people that are just starting out that should be able to have a lot more freedom than they currently do. I would get aggressive with it and try to get it out of your budget as fast as you can.

Brett McKay: All right, so prioritize that if you have it.

Jesse Mecham: Absolutely.

Brett McKay: One piece of financial advice that goes against the grain against a lot of financial advice out there, I mean like an article of faith of all personal finance people is you have to have an emergency fund and you’re saying no, if you do it, I say you don’t need that. Talk about that.

Jesse Mecham: Yeah, I mean let’s say you didn’t take my advice. You took their advice. More cash on hand is better, so you won’t be wrong if you decide no, I’m going to have six months cash, so I’d say okay, you’re going to be fine. What we’re talking about here is when you’re living that rule two, where you’re looking ahead and you’re saying okay, home repairs, car repairs and you’re just starting to give really specific names to these events that happen, most YNABers that have been doing this for a while, they’ll write to us and they’ll say I have a three month emergency fund, I never ever touch it and the reason they don’t is because they’ve named all those “emergencies” and they just don’t have, they’ve already prepped for them specifically, and what you use to call an emergency and you’d go into your emergency fund and you pay out of it and you’d be kind of sad that you had to make your savings account balance go down, even though the money’s there for that but you’d still feel guilty about it.

People instead just say yeah, that was for my car tires and they’ve got money for it and the emergency fund just sits there. I would encourage people if you wanted to set aside money for real emergencies, once you’ve got your feet under you, follow rule two. You’ll just realize I’ve got money here for everything darn close, I would look to an emergency fund for really big things and I would call it those things. I would call it like job loss or big life shifts or something, where you’re calling it really what it is and you’re being very specific about it. What happens is people will say I’ve got this emergency fund and then they’ll use it when the new iPhone comes out because their iPhone gets a little crack and they’re like I guess I need a new phone or I need a new computer and they wonder why their savings account doesn’t grow and it ends up becoming this holding place until something is deemed an emergency, and so you have this flexible definition that could then raid that pile of money.

People always will be like yeah, for some reason, my savings, it just doesn’t go up. It’s a revolving door, money in, money out just depending on your mood, oh is this an emergency? I guess it is, and I would stress for people name those things, prep for them in an intentional meaningful way. This is for a new computer instead of this is just money for whatever I end up calling an emergency. At the end of the day, all the advisors, we’re all saying the same thing. Have money on hand. Don’t go to your credit card to handle that “emergency” and you’ll be far, far ahead of the rest of the pack.

Brett McKay: Another thing you’re talking about in the book, because you’re not like the other budgeting gurus, whatever, I won’t call you a guru.

Jesse Mecham: Don’t call me. You can call me a guru if you want.

Brett McKay: It’s like avoid credit cards at all costs, and you say well if you want to use a credit card, that’s fine. Just use it responsibly, and you had this idea that, I don’t have a credit card so it’s been a while but you’re talking about the credit card float and how that can just screw up your budget. Can you talk a little bit about that?

Jesse Mecham: Yes, so most people, and I’ll speak to those that would tell me I use it responsibly and I pay it off every month, there’s a good chunk of people that do that. The majority of people lose when they’re playing that game with the credit card companies. I attend my payment conferences where they’re talking about innovative ways that payments will be a new thing in the future, like your car will go up to a drive through and your car will be payments enabled. I promise you this will happen. I saw Visa talking about it, and your car will just pull up and they’ll recognize you and the car will actually know it’s you and you’ll just pay and they’ll hand you your food, and they’re trying to remove friction from the payment process at every step so I’m taking a step back here from the credit card question just for a moment, but the idea that credit cards remove friction is very, very obvious and what we want to do, the reason they remove friction is because it’s convenient. It’s fast, it makes the effort more pleasant and it keeps the person spending more and a credit card company makes money when you spend more money. Their interest is lined up to have you spend more.

You just have to know that going in, so when you grab the plastic, just know this piece of plastic, it is built to have me spend more. We started there with that as a baseline, and it’s not an assumption. That is a truth. That is they only make money when you use their money because they get all those percentages of fees, so then starting there you’ll have someone say I only, I pay it all off, I never pay them a dine. I get points, cool. I literally pay for my car with credit card points, no joke, so I understand the points, but what happens is they have done that and they’re saying I pay off the balance every month. The test you need to give yourself, if you’re one of these people is, could you right now, if you look at your bank account balance and you look at your credit card balance, could you pay off your credit card right now at any given moment at any time in the month, could you pay it off? If you can, okay, you’re doing okay, but if you can’t, it means you’re floating. You’re on that credit card float.

What people are doing is they’re spending on their card accruing debt and then waiting for the paycheck to land so that they can pay off their card. They are in debt until the paycheck lands and they’re paying it off. What we want is you’re running up a credit card responsibly, all in line with your budget and you have the money there at any given moment set aside that you could pay that card off. Once you do that, I say okay, you know you’re playing with fire a little bit, you know you’re playing with a tool that is built to have you spend more so you know all that and you still are living in line with your budget. Every dollar has a job, you’re sticking to it, your priorities are being hit, cool. Knock it out. Get those points, whatever you want to do. At the end of the day, it’s just a payment instrument but it’s a pretty sleek one, and there are a lot of bright minds behind the scenes that are being paid lots of money to try and figure out how to make it as sleek as possible.

Just know that going in and if you are floating, stop using your card until you’re not. You don’t want to be floating. You’ve removed some scarcity from your budget and that can kind of throw off your budget.

Brett McKay: It sounds like you should just treat your credit card like a debit card.

Jesse Mecham: Absolutely. I should have said it that way, my answer would have been a lot quicker because that’s exactly it.

Brett McKay: Let’s talk about the inflexible because I think that’s where most people give up. They’re doing their budget and then their budget doesn’t go according to plan and they say to heck with it, I’m just going to throw it out the window. What does that flexibility look? Is it everyday you’re adjusting your budget? Every week? What does that look like?

Jesse Mecham: When you’re first starting, it might be everyday, just because you really don’t know how things actually go. You’re setting up a plan and you’re saying this is my reality. I want to live by this reality, but you don’t really know if you’re first starting out what kind of reality you’re dealing with, so it could be literally daily and with us, it’s on our phone, you’re moving money around. We make moving money from category to category very easy on purpose because we know this is a function that people want, that they need, so yeah, it can’t be daily. For me and in my personal system, I’ve been doing it for so long, people have been doing it for a long time, they end up adjusting maybe weekly and some even less than that. It’s really a matter of how big is the overage and how much other room you have on your budget. If you’re dealing with category, total checking account balance of $3,000 and you just overspent by $1,000, that’s a big deal. You’d be juggling right away, but if you overspent by $50 and your budget’s $3,000, fix it but there’s nothing’s going to happen that’s going to really set things on fire.

There’s a little bit of a judge of materiality in the budget there and then when you’re first starting, fix it often so it just reinforces that behavior of hey, when something happens, I’m just rolling with the punches. I’m just adjusting, and that’s just good budgeting because you’re saying like your budget doesn’t go according to plan but the budget really is the plan and so your plan needs to go according to reality. That’s all you’re doing is adjusting to reality everyday. That’s how you win. It’s absolutely how you win, and people just need to let go of the idea that they have this crystal ball that tells them exactly how life will go for the next month. There is no normal month. You just adjust as needed your whole life long.

Brett McKay: Right, so how do you handle your income growing up? As it goes up? For example, I was in the same boat as you, married in college, broke, so it was really easy to budget like scarcity existed but I remember I got my first job, my first paycheck, I’m like oh wow, this is amazing and the budget’s like oh, nothing to worry. How do you need to budget, like this system adapt itself as your income goes up?

Jesse Mecham: Yes, so maybe there are a few more zeroes on the end of things but the idea is still, and we have really good data around money stress and level of income and there’s basically no relationship. I was chatting with a guy. He makes $200,000 a year. It’s paycheck, it’s salary. He can bank on it. He makes bonuses as well and his average checking account balance would end up floating around $500 every time and when you’re making that much money and your checking account balance is sitting there, you are spending down to the bone and he was so stressed. We got him figured out and he’s actually retired now. He’s making so much money he’d made all sorts of life changes, but at the end of the day, we got it all square. Someone making $40,000, $30,000, same thing, they’re stressed and if you can get their money just lined up with what they really want, that stress goes away.

The fundamentals don’t really change as the money gets larger. What happens is you do, you do have more wiggle room. I don’t stress about the fact that I need to renew my registration for my car. I remember when I first had to renew it, we were first married, bought our first car, I never owned a car before and we get this bill a year after we bought the car saying you owe us $125 for registration. I was blown away. I’m like $125, not by a textbook, surprising as they were. It threw us off, so there are things like that. Now $100 surprise to me won’t, I won’t sweat it now like I used to but the principles are still the same where whatever amount of money you have, make sure that it’s doing what you really care about, and if it is, you can design the life you want and have your money serving that purpose instead of having it just be a source of stress and relationship woes a lot of the time.

Brett McKay: This prioritizing, giving every dollar a job is, I mean it’s difficult if it’s new for you but it’s easy when it’s just you. How do you do this when you bring in a spouse who might have other priorities that are different from yours, other ideas about money and how to spend it, what does that process look like?

Jesse Mecham: When you’re first merging finances and there are things that each partner brings, they bring different habits with their money, they bring different bigger conceptual ideas about money and then they bring actual money or debt to the relationship. You want to know what are their habits and especially what are their big ideas. Today, their credit card is like a magical tool that gets them what they want right away or do they think it’s from the devil and were they raised a certain way and how do their parents behave around money? You can start to explore that with your significant other and you can say what were your parents like with money? Did you ever hear them talk about it? What did they teach you? You just kind of explore that, not talking about money like dollars, amounts, just talking about the idea and that can do a lot of getting to know you type stuff. You go a long ways with that.

Habits might be they like to shop to relieve stress. They always like to go out and get a coffee every morning and all those habits that come along with it, you need to know about them, but at the end of the day, when you said like they have their own priorities and you have yours, that is exactly the right kind of thinking. You have to recognize that when you’re budgeting together, there are three sets of priorities. You have yours, mine and ours, and those three play a, they’re vital that you are clear with each other on whose priorities are what so that you can speak intelligently to it, so when my priority is this puppy I bought and I want to train and I want to get all this gear for this puppy, Julie’s like okay that’s yours and her priority might be I want to do lunch with friends a couple of times or whatever it may be or she loves furniture. She just loves it and I couldn’t care less about it, so she’s recognized like oh, this is one of my priorities.

She loves cooking, so the grocery budget, she cares so much more about it than I do because she wants to be able to buy stuff to make this or that new recipe or things. It’s just one of her huge hobbies. When you recognize that early on, then it frames the conversations to be so much easier where you’re like okay, what do you want for your hobby with this dog? What do you want to do? Okay, well here’s what I want to do for this and I’m thinking about that and you fund it. You just put money in those spots and then you have the our priorities, like for us it’s travel or we want to have really fun experiences with the kids. They don’t need to be expensive but we want to make sure that they’re being done so we have categories for each thing that we want to do, like we want to go visit some family here, we want to go see some historical sites, whatever it might be and we make sure those things actually happen.

The budget at the end of the day ends up being a little bit of a to do list for you and for your spouse where you can, it’s like the things we want to achieve, some things only you want to do, some things only I want to do and some things we’ll want to do together. I think respecting that, that goes a long way towards really being able to communicate well about it, because there’s too much finger pointing with money in relationships so we really want to get away from that.

Brett McKay: How do you teach this stuff to your kids? I think all of us want our kids to be responsible with money.

Jesse Mecham: Yeah, I think a ton about that. One, it’s super fun to teach them, so the book goes into pretty good detail but there’s I’ll just share one thing that I really have enjoyed, and they are far easier to teach than we are, so as adults, we come with all sorts of baggage, like right from the beginning we were saying this is about budgeting and people are thinking oh man, gosh, do I really want to even listen to this episode? I don’t really want to hear this, and with kids you’re like hey, we should do a budget and they’re like what’s a budget? Well, a budget’s a way for you to make sure you buy the things you really want. They’re like okay, that sounds pretty good so far, and then you just say what do you really want? I would talk with maybe Harris and he’s 11, so he’s in this awesome age right now where he’s interested about everything. I’m like Harris, weren’t you saying you wanted a hover board? Oh yeah, yeah I totally want a hover board. What about that Nerf gun? Wasn’t that one that was automatic that you could just hold out? Yeah, I want airsoft. Oh airsoft, we’re talking about airsoft now. What’s that? Do you need gear for that?

You really stoke the fire that’s already in him and you get him just to list 25 things, all these things he wants. They love it. It’s like a Christmas list. Then you say Harris, how much money do you have? I’ve got $50. Well, how do you want to allocate it to these so that we can have you buy one of these things? Suddenly, he’s like oh, well this list is way too long. I’m yet to see an exception to this where the kids don’t just zero in on that one thing that they really want and then throw all the money behind it, and it’s like they have this innate ability to prioritize, where we as adults are like should I do this? My friends do this, should I be doing that too? All these things where the kids are like I want that, I’m going to have that.

You get them giving, you get them saving for long term like college or something like that, and then the rest of that money, for us, we have our kids just you can do whatever you want with it, and we teach them about that prioritization and they do it naturally. I mean they do it so much easier than we do, so it’s just fun to watch. You got to be patient with them. I started when they turned eight. It seems like they’re old enough at that point to really get the gist and then one thing I learned from Ron Lieber, he’s a New York Times columnist that I chatted with a while ago, really helped me. He gives an allowance to the kids just unhinged from any other chores or anything. It’s just here’s this money and it’s not because you’ve done any work, and at first I was thinking, no, no, you work, you get money. That’s how life is but he said no, no, the allowance is just there to teach them how to use it. Teach them how to use the money.

We have our kids work. They do office work for me like clean the office and stuff and they earn money that way but with allowance, it’s just here’s the money and let’s teach you how to manage the money and not have it married to how well did you clean your room or whatever, and it’s a small amount but that really freed up me and Julie. We just gave them the money and said the money is there to teach a lesson and it’s not the lesson to work for money. It’s just a lesson of how do we manage it. Those are two kinds of things they have keyed in on. They learn easily and allowance is just something to help.

Brett McKay: This is what we do with the allowance, you just give it, our son Gus, he’s seven. He gets an allowance but it’s not tied to chores. We don’t want him, we want him to do the chores because he’s a part of the family because I think if you throw him the money and you forget to pay him his allowance, he’s like well I’m not going to pay my room because you didn’t give me my money. This has been great. What do you do whenever you’re doing all this stuff and there’s always that moment. This happens with dieting, with exercise. I’m sure it happens with budget where you’re just like I don’t want to do this anymore. I want to give up. This is too hard. Any advice for those folks out there?

Jesse Mecham: One thing like in exercise, I’ve noticed I’ll just change it up. I’ll get a new, I’ll just dial in a new routine. I’ll say I’m going to do this instead, and that seems to kind of reenergize me to approach maybe I’ll focus on a specific lift or whatever but I don’t know, you see with new eyes and you get new excitement and the book goes into a few different reasons why we want to quit but the one I want to key in on here is just starting fresh with it goes a really long way toward seeing it with new eyes, and that would mean that you just throw out your whole budget and you look at the pile of money that you have on hand and if you’ve been doing YNAB for a while, the pile will be bigger than when you started. With that brand new pile of money that’s unassigned to any job, you would just sit down, if you’re sharing finances, you sit down with your spouse and you’d say okay, here’s this big pile of money, what should this money do? You start from the top. You think oh we got to pay the mortgage, you start working your way down.

A lot of the stuff’s going to be the same but it’s seeing that large pile and knowing that it’s not spoken for, it kind of breathes new life into the budget and can reinvigorate it. That’s one, one piece of advice that I would give is just maybe start fresh with it and see if you can breathe new life into it that way.

Brett McKay: Well Jesse, this has been a great conversation. Where can people go to learn more about the book and your work?

Jesse Mecham: The book you can find at any retailer. It’s just called You Need a Budget and you can go to youneedabudget.com if you’re in a hurry, you can do ynab.com. It’s YNAB, and yeah we have a ton of resources out there. You can take three online workshops that we run all the time and you can read, watch videos. We really try and teach. We just teach and get it all out there and then if you like our tool, that’s how we make our money but we teach for free and it’s working well for us so far, so yeah I’d encourage people just to check that out.

Brett McKay: Awesome, Jesse Mecham, thank you so much for your time, it’s been a pleasure.

Jesse Mecham: Thank you.

Brett McKay: My guest here is Jesse Mecham. He’s the author of the book You Need A Budget. He’s also the creator of the software of the same name You Need A Budget. You can find the book on Amazon, available for pre-order right now and you’ll find more information about his software and service at youneedabudget.com or you can just type in ynab.com. Also check out our show notes at aom.is/ynab where you’ll find the links to resources so you can delve deeper into this topic.

Well that wraps up another edition of the Art of Manliness podcast. For more manly tips and advice, make sure to check out the Art of Manliness website at artofmanliness.com. If you enjoyed the podcast and got something out of it, I’d appreciate if you take one minute to give us a review on iTunes or Stitcher. It will help us a lot. If you’ve already done that, thank you. Please share the show with a couple of your friends, word of mouth is how this thing’s spread. The more the merrier around here. As always, thank you for your continued support and until next time, this is Brett McKay, telling you to stay manly