With our archives now 3,500+ articles deep, we’ve decided to republish a classic piece each Friday to help our newer readers discover some of the best, evergreen gems from the past. This article was originally published in May 2015.

When you’re in your twenties, you may not think too much about getting your financial house in order. Such a goal may feel like the kind of thing you can work on once you settle down and start your “real life.” After all, it may not seem like you have many assets to manage; you may be just out of college, still in debt, and not making much money at your first job. But even so, there are steps you can start taking now that will lay a good foundation for building wealth and security as you get older.

Every man is different, so naturally everyone is going to have different financial goals. But if you’re feeling confused and overwhelmed about money, it’s sometimes helpful to see suggestions for milestones to hit at certain points in your life. You can then take those broad suggestions and refine them so they fit your personal circumstances. With that in mind, here are 11 financial goals to work towards in your twenties:

1. Start Educating Yourself About Personal Finance

One of the weird things about the modern age, is that even though money plays such a huge role in our lives, most of us don’t get any formal personal finance classes in school. Parents often don’t talk with their kids about the finer points of money management either. This is unfortunate, because knowledge truly is power.

When I was in law school I started a blog called The Frugal Law Student. I wanted to share tips with fellow law students about how to save money while getting your JD. Yet at the time, I didn’t know much about personal finance myself! So I went into autodidact mode and started learning about money, saving, and so on. This self-taught course really enriched my life.

You don’t have to start a blog to become a savvy money manager. It’s never too late to start educating yourself about the world of personal finance, and it’s as easy as reading the vast amount of free content online about the topic. Here are some of the sites I found invaluable during my own finance education (as well as a few that started after I hung up my FLS hat):

- Get Rich Slowly

- The Simple Dollar

- I Will Teach You To Be Rich

- Wise Bread

- Mr. Money Mustache

- Consumerism Commentary

- Mint.com Blog

- Financial Samurai

- Two Cents (by LifeHacker)

- Coursera (while not a blog, Coursera offers several personal finance-related classes)

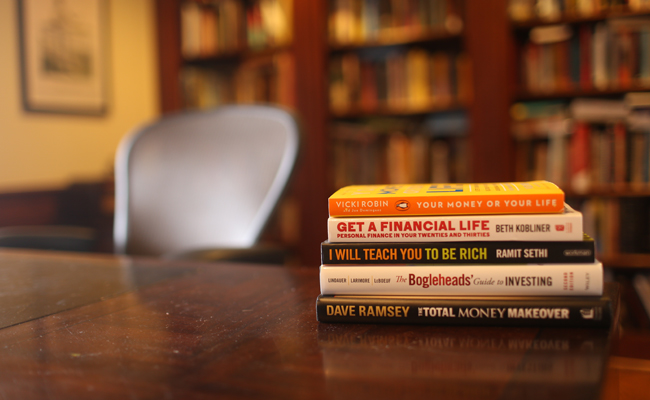

In addition to reading personal finance sites, I read pretty much every single book on personal finance in Tulsa County’s library system. You can find a list of the books I found the most useful here. You’ll discover that those books, and personal finance books in general, often say similar things, but reading multiple sources with slightly different angles and perspectives is helpful in ingraining the fundamental principles of personal finance into your brain.

2. Create a Budget

There’s a moment from my college days that I distinctly remember. It was just a few months after I was completely on my own for the first time. I was going through a stack of bills I needed to pay, and suddenly felt overwhelmed. I made just enough with my job as a waiter to cover my expenses. It felt like I would never get ahead financially with the way things were going.

Whenever I get down like that for any reason, instead of wallowing, I like to take some kind of action. So I busted out some paper and scribbled a rough budget for myself. By being able to see the bird’s-eye view of my financial life, I had more of a sense of control over my finances. I could see I was spending money on stuff that I didn’t need, like cable, and I realized that I could probably cut back on food expenses by making meals at home. I started feeling more hopeful about my situation after finishing my budget.

After that experience, I kept up the practice of maintaining a budget and it served me well. Budgeting allows you to make informed, purposeful decisions as to how to allocate your money in the best possible way to reach your goals.

If you haven’t already, make it a goal this week to set aside an hour and create a budget for yourself.

For more information, see our article on how to create a budget, and/or listen to my podcast with Jesse Mecham on the subject:

3. Research Health Insurance Options

While the number of young people with health insurance has been increasing due to the Affordable Care Act, they’re still less likely to be covered than other demographics. Many young men forgo insurance because they feel like it’s cheaper to pay the penalty to Uncle Sam than it is to pay a monthly premium for a service they’ll likely never use. (This is something to keep an eye on; the penalty has rarely been enforced, and very likely to be abolished altogether by the Supreme Court. It’s an evolving situation here at the end of 2020, so do your homework.)

While I understand this cocksure attitude, it’s always better to be safe than sorry. As someone who worked in the bankruptcy courts, I’ve seen firsthand the financial damage that unforeseen medical expenses can cause. Most of the folks filing for bankruptcy were there because they weren’t able to pay for unexpected medical bills.

Don’t take that risk. Just get the darn health insurance. If you have a job that offers health insurance, explore your company’s options. If you don’t have a job that offers health insurance, search your state’s insurance exchange for an affordable plan.

If you’re healthy, you can save some money on health insurance by opting for a high deductible plan and opening up a health savings account (HSA). You’ll pay a lower monthly premium, and the money you set aside in your HSA is tax deductible.

For more information, see our article on health insurance for young adults.

4. Start an Emergency Fund.

Sh*t happens! Instead of taking on more debt to pay for an unexpected car repair, use the cash in your emergency fund. That extra cushion of cash can go a long way in helping you achieve your long-term financial goals. When Kate and I were newlyweds, we always kept at least $1,000 in a savings account. There were several times when we were forced to dip into it for car repairs and the like, but because we had the money there, we never felt strapped for cash, even though we weren’t making much at the time.

Make it a goal to set aside $1,000 to start your emergency fund. I use CapitalOne 360 for our family. Once you pay off your high-interest consumer debt (see below), you can set the goal of creating a fund to cover 3-6 months of basic living expenses.

For more information, read our article on how to start an emergency fund.

5. Eliminate Credit Card Debt

One of the best investments you can make in your young financial life is to eliminate high-interest credit card debt. With the average interest rate hovering around 13%, credit card purchases can get really expensive, really fast. As personal finance author Beth Kobliner notes in her book Get a Financial Life, when you pay off a credit card bill with a 14% interest rate, “you’re in effect paying yourself 14%, guaranteed, and tax free.” That’s an amazing return on investment!

Make it a goal to pay off your credit cards as soon as possible. There are several approaches to doing so, which you can read about here. Once you’ve got them paid off, consider getting rid of them. I know there are all sorts of arguments for keeping a credit card around — they’re great in emergencies, you can earn rewards and cash, etc. I don’t deny that, if used properly, a credit card can be an extremely useful tool. It’s just so laden with possible pitfalls (accidentally miss a payment, rate hikes, etc.) that the downside often outweighs the benefits.

It’s possible to navigate life without a credit card. After Kate and I paid off our respective cards about nine years ago, we never renewed them. We just pay cash for everything (in the form of a debit card, or actual greenbacks). I’ve yet to regret the decision.

For more information, see our article on starting a debt reduction plan.

6. Start Tracking Your Credit Score

While you might not be planning to purchase a home or a car anytime soon, once you do, you’ll need to have good credit to take out a mortgage or a car loan. The financial moves you make when you’re 23 and dirt poor can affect your credit score when you’re 33 and applying for a mortgage. So it’s a good idea to start tracking how the banks view your creditworthiness by requesting a free yearly credit report and checking your number every year or so.

Reviewing your credit report at least once a year can also ensure that you catch illegal loans taken out in your name by identity thieves. The earlier you catch fraudulent loans, the easier it is to do something about it.

For more information, see our article on understanding credit scores and reports.

7. Start a Retirement Account

It’s almost become a tiresome cliché in personal finance books and blog posts, but it doesn’t make it any less true: time is your biggest ally when investing. To show you the power of time on your investments, let’s look at an example from the book Get a Financial Life:

Suppose you set aside $1,000 a year from age 25 to age 64 in a retirement account that earns 5% a year (historically, stocks return about 8%, but we’ll be conservative). That’s $39,000 total you invest. By the time you turn 65, you’ll have $126,840. If you don’t get started with saving until you’re 35, you’ll only have $69,760. Starting just ten years earlier would have doubled your total. Yes, doubled.

Starting early with retirement pays off big time down the road.

So after you’ve started that emergency fund and after you’ve paid off that high-interest credit card debt, start a retirement account. If you have a job that offers a 401(k) plan, sign up. Don’t know which investments to fund your account with? Go with index funds. If your employer offers 401(k) matching, contribute at least the minimum amount for which you’re eligible to receive matching funds. But the more, the better.

If your job doesn’t offer a 401(k) or if you’re self-employed, open up a Roth IRA account. Your bank likely offers one or you can use an online broker service like Vanguard or Fidelity. Fund it with index funds.

Aim to contribute at a minimum 5% of your gross income to retirement. As you start to pay down debt and increase your emergency fund, bump up your savings rate.

For more information about retirement accounts, see our articles on:

8. Plan Your Debt Repayment for Student Loans

Once you’ve paid down your high-interest debt, set aside $1,000 for an emergency fund, and opened up that retirement account, the next step is to put in place a plan to pay off the rest of your debt, and for most 20-somethings that debt is going to be made up primarily of student loans.

The college debt many young people are carrying is keeping them from pursuing large life goals like getting married and buying a home, even when they’re well into their 30s. To give yourself some more financial flexibility to have a baby or start a business, make a plan to pay off your college debt as quickly as possible.

If you have any private variable loans, pay those off first. Sure, the interest rate on them might be lower than federally backed student loans, but if the Fed decides to hike interest rates in the future, the rate on those variable loans could climb 5-6%, says Mark Kantrowitz, publisher of FinAid.org. That could make your payments on those loans unmanageable. Better to pay them off now.

For your federally-backed student loans, you have seven repayment plans to choose from. Most young people make the mistake of picking the plan that has the smallest monthly payment. Doing so causes you to pay more on interest over the loan’s lifespan.

If you’re single or married with no kids, be aggressive with your student repayment; being a bachelor is a great time to learn how to live spartanly and simply. Slash your expenses, earn extra money through side hustles, and divert your savings and income towards paying off your debt as quickly as possible.

If you’re not in a position to be super aggressive with your loan repayment because you have kids, or you’re just not making enough money right now, at least aim to put 10% of your gross income towards student loan debt. As you make more money, increase the amount of money you use to pay down your debt.

9. Start a Side Hustle

Besides finding ways to save money while in your 20s, start looking for ways to earn more moola. Getting in the habit of creating multiple income streams will not only build your personal wealth, but serve you well as you get older. With today’s volatile and competitive job market, you can’t rely on a steady paycheck from a corporate gig. Don’t put all your eggs in one basket — have other sources of cash coming in.

An easy way to increase your income is through a side hustle. Side-hustles are little micro-businesses that you can run when you’re not doing your day job. It could be something as simple as mowing lawns on the weekends or proofreading resumes. If you’ve got a skill, there will be someone willing to pay you for it.

When I was in college, I waited tables, but I had a side hustle tutoring Spanish. I just put up flyers in the building that housed the foreign language classes. Within a week, I had four weekly clients. At $20 an hour, that was an extra $320 a month for my wife and I. That covered more than half of our rent, giving us more money to put towards other financial goals.

For more information about starting a side hustle, read our several articles on the topic.

10. Practice Negotiating

If there’s one skill I wish I spent more time developing in my 20s, it’s negotiating. I suck at it. I’ve probably left thousands of dollars on the table because of my haggling deficiency. That stings.

By being comfortable with negotiating, you’ll save and earn more money in the long run. So start mastering this art today.

You can negotiate the price of everything — homes, cars, appliances, phone bill, car insurance. Practice makes perfect.

You also make more money by negotiating for a higher salary or hourly rate. With a few hours of preparation and a bit of confidence, you can increase your income by thousands of dollars in just a few minutes time.

11. Set Long-Term Financial Goals

If you can accomplish the above ten financial goals, you’re going to be in a great position financially compared to other 20-somethings. It’s now time to start thinking about longer-term financial goals. It could be saving up a certain amount for a down payment on a home or getting a certain net worth in your 40s. If you’re on the cusp of your 30s, here’s a list of goals for that decade to start thinking about. Whatever your aims are, write them down and start taking steps to make them happen.