Editor’s note: This is a guest post from Josh Tucker.

Good Sir,

You are going to die.

This is a simple fact. No matter your religion or your philosophy, we all leave this world at some point and enter the great Hereafter.

For most, this fact can be terrifying. But keeping a stiff upper lip in the face of an uncomfortable truth and, most importantly, confronting a hard truth with smart action are two of the great bedrocks of manliness.

So, gents, we are all going to die. Now what are we going to do about it?

Think of Aesop’s fable “The Ant and the Grasshopper.” Do you want to be a grasshopper who sings all summer and fails to provide? Or do you want to be an ant who knows that winter is coming and diligently prepares?

I say be an ant. Let’s get started.

Why You Need Basic Estate Planning

You may be in your twenties. Or single. Or childless. You may have no assets other than the brain in your head, the clothes on your back, and the smile on your face.

You may be thinking, “Why should I worry about estate planning at all? This seems boring, pointless, and morbid.”

Well it may be a tad boring until you realize the importance of the task. Protecting your legacy may be the manliest endeavor of all.

We are not talking about writing a will that leaves your coin collection to your cat. We are talking about nothing less than you taking control of your own legacy so all that you work for will be best used according to your wishes. And, just as importantly, we are talking about protecting you so that you keep your most intimate decisions firmly in your control during a time of crisis.

Do not let some judge be responsible for sorting out who has the authority to make the decision about whether the hospital must keep you on life support if you are a burden to your loved ones. And do not let your loved ones suffer the stress of sorting out your finances when they should be grieving for you.

So let’s get to work.

And to work smart, let’s get a precise definition of “Estate Planning” in place so that we know what we are working toward. After all, the easiest way to miss your target is to aim poorly.

Estate Planning is simply the preparation of legal documents that give answers to three crucial questions:

- Who do I want to make medical, legal, and financial decisions for me in the event that I am alive but unable to make decisions for myself?

- What happens financially when I die (i.e., what happens to what I own, what happens to what I owe, and what about stuff like life insurance that becomes due when I pass away)?

- What end-of-life medical decisions do I want to make for myself now so that my loved ones can follow my directions later (e.g. do I want to donate my organs, do I want to be kept on life support, etc.)?

Step One – Gather Information And Get Started

So with that definition in mind, you first need to sit down and do some thinking. Ask yourself these basic questions:

- If I am in a coma and cannot make medical decisions, who would I want to make decisions for me?

- If I was incapable of making financial or legal decisions, who would I trust to make those decisions because I can be sure that he/she would best look out for my interests?

- Who do I want to make sure I protect in the event that I am not around anymore? Or, what happens to my loved ones if my significant other and I die at the same time, like in a car accident?

- What is my basic financial situation? What do I own and what do I owe? Do I have life insurance?

Estate Planning Terms

After you’ve done some thinking, it will be helpful to understand the terms and documents of estate planning. (Please note that I am writing this from my perspective as a Kentucky lawyer. The terminology and specifics will change by state and circumstances.)

Here are the terms that you need to know:

- Estate. An “estate” is the legal entity that stands in for your interests after you die for the time it takes to wrap up you affairs.

- Executor/Executrix/Administrator. Depending on your state, there may be a different term. But, simply, this is the person who is responsible for settling your estate — for carrying out your wishes according to the requirements of the law.

- Trust. A trust is (most likely) not going to be part of your basic estate planning, but you still need to understand what a trust is because it can be used for targeted purposes, such as providing for a special needs child. A trust is simply the placing of assets in the care of a third person who will manage those assets for the benefit of another person.

- Probate. “Probate” is the legal process that a court follows in settling estates.

- Testate v. intestate. Testate means that someone died while having a valid will. Intestate means the deceased did not have a valid will. If you die without a will, the laws of your state will determine what happens to your assets without you having any say in the matter.

Estate Planning Documents

Now that you understand the basic terms, here are the basic documents that you need in place. Keep in mind that this could vary state to state, so no matter where you live, you’ll need individual professional help for your situation:

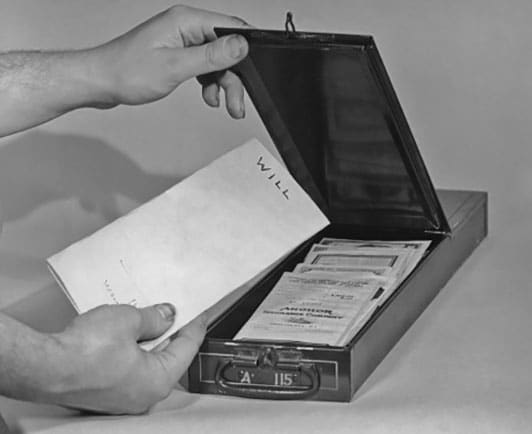

- Will. A will is a document that allows you to provide a plan for the distribution of your property in the event of your death. If you have a valid will at the time of your death, then it will be filed with the appropriate court and probated.

- Living Will. This is sometimes also known as an “advance health care directive” or something similar. The point is the same: this document allows you to make future decisions about your health care in the event of calamity. In most states, you can decide in advance whether you want to receive life support if you are incapacitated and there is no reasonable hope of a recovery. And you can decide if you want to be an organ donor, etc. The point of a Living Will is this: you decide in advance which health care decisions you want to make in the event that you are incapacitated, and you put those wishes down on paper so that others can follow them when the time comes.

- Health Care Surrogate Designation. This is very similar to a Living Will. The crucial difference is that with a Living Will, you are making future health care decisions for yourself and then giving everyone else notice of your wishes. With a Health Care Surrogate Designation, you are simply designating a person who will make your health care decisions in the event that you are not capable of doing it yourself.

- Power of Attorney. Like a Health Care Surrogate Designation, this document allows you to decide in advance who you want making decisions if you are not capable of doing so yourself. A Power of Attorney nominates the person of your choosing to make financial and legal decisions for you if you cannot do so.

With a Will and Living Will, you make future decisions about your assets and your health care. You decide in advance what you want and then your wishes are to be fulfilled according to the relevant law.

With a Health Care Surrogate Designation and a Power of Attorney, you decide who will make decisions for you in the event that you can’t.

Also, remember that the titles of these documents will change by state, so do not be alarmed if your lawyer uses a different term for a document that has the same basic effect of what I have outlined above.

These are the basics. Now let’s get to work installing them to your benefit.

Step Two – Take Action!

Next, you need to get professional help in order to make sure that you accomplish your goals.

I suggest that you begin by finding a good lawyer with experience in estate planning and, most importantly, that you trust.

In full disclosure, I am a lawyer. I know we aren’t held in high regard by all, but I strongly suggest that you talk with a lawyer about this for three reasons:

First, This Is Easy To Screw Up On Your Own

Estate planning is very technical and there are details that you may think are insignificant but can have huge consequences. For instance, I once knew of a man who tried to save a few dollars by getting a power of attorney document off of a website. Unfortunately he did not know that he needed a durable power of attorney and so it did not protect him when he needed it most. (That distinction matters in my state.)

Do not be that guy.

Websites that sell DIY legal documents and those self-help divorce shacks in the bad part of town do a great job of selling you on the ease of doing legal work for yourself. Do not underestimate the ramifications of screwing up what seems to you to be a trivial detail. It can cost you and your family dearly…at the very worst possible time.

A failure of a signature or an insufficient notary or witness can invalidate your plans. And if your will is invalid, your assets will be distributed according to the general laws of your state rather than your individual wishes.

Second, A Professional Makes Sure This Job Gets Done Right

I sometimes run across situations where clients come to me with documents that have been slapped together from a form on the internet or from someone retyping great aunt Gertrude’s will and changing the names, or what have you.

Well this, of course, invariably creates significant problems.

And I am also always surprised at how many documents cross my desk that are not even signed. I am talking about contracts for major amounts of money, business partnership agreements, etc.

Do not let this happen to you. Get a lawyer so it gets done right.

According to Abraham Lincoln, “A lawyer’s time and advice are his stock in trade.” I think Abe, being the great man he was, took for granted that a lawyer’s time and advice are to be used to produce great results for his client. That is the stock that good lawyers trade in.

So when you go to a reputable professional, you are buying the security that a smart, knowledgeable person will invest the time necessary to do the job and do the job right.

Estate planning is one of the easiest things in the world to procrastinate on. By going to a lawyer, you are putting your money where your mouth is and hiring someone else to make sure that an essential job gets done.

Third, A Good Lawyer Will Make It Easy To Accomplish

For a topic that deals with thoughts of death and calamity, you will probably be surprised at how painless the process actually is. For most men reading this, you can probably accomplish your basic estate planning in two visits to a lawyer’s office.

You will likely go for an initial consultation where you (and possibly your spouse or significant other) will sit down with the attorney and go through your situation and develop a plan. Then the attorney will draft the documents necessary to carry out that plan. They will usually email or mail you drafts for your approval. Then, you will go back to the office and go through the hoopla of signing everything. (I say hoopla because, depending on your state, the signing can be a bit of a process. For instance, in Kentucky a will has to be notarized and signed by two disinterested parties who must witness your signature.)

And then you will be done. You will have taken the essential steps of protecting your legacy and removed a significant load of the burden off of your family in the event that something tragic and unexpected happens to you.

Again, this is so easy to procrastinate, yet so essential. Do it. You will be so glad you did.

Step Three – Keep Up The Good Work

Once you have your basic estate planning in place, you will probably be done for a while. You will just need to occasionally revisit the issue. It is best to check in with your lawyer every time a major life event happens. For instance:

- The birth of a child or grandchild

- A new committed relationship or a break-up

- Any significant financial event (an inheritance, a new job, etc.)

- The death of anyone named in your will

- If nothing changes, it is not a bad idea to check in every few years just to make sure your estate plans are right for your current situation

A simple call or email will suffice. Just explain the situation and ask your attorney if any changes need to be made. He or she should handle the rest.

Let’s face facts and act accordingly. Estate planning is not fun but it is necessary for all of us. Take action, cement your legacy, and short-circuit pain for you and your family. It just takes one call to start the process of proper preparation.

Ben Franklin said it best, “By failing to prepare, you are preparing to fail.”

Do not prepare to fail. Prepare to leave a lasting legacy.

Be an ant. Prepare while the sun shines so your family does not have to go begging when winter inevitably comes.

P.S. I have purposefully excluded as much legalese and mumbo jumbo as humanly possible while still giving you food for thought. But I will provide this disclaimer: this is not legal advice. The point of this article is to demonstrate to you that legal advice is almost certainly going to help you out. Please act accordingly.

P.P.S. I would love to hear about the burning questions you have in this area. Let me know about your frustrations and your pain points. My personal email address is [email protected].

_______________________

Josh Tucker is a lawyer in Nicholasville, Kentucky who handles family court cases, criminal cases, and estate planning issues.